House Hunting 101: How to Find the Perfect Home for Your Budget

Finding the perfect home can be both exciting and overwhelming, especially when you’re working within a budget. Whether you're a first-time homebuyer, a military family navigating a PCS move, or a renter looking to make the leap to homeownership, knowing how to approach the home-buying process is crucial. Here’s a step-by-step guide to help you find the right home without breaking the bank.

1. Determine Your Budget

Before you start looking at homes, it's essential to know how much you can afford. Consider the following:

-

Get pre-approved for a mortgage: This will give you a clear idea of your loan amount and strengthen your offer when making a bid.

-

Factor in additional costs: Beyond the purchase price, consider property taxes, homeowners insurance, HOA fees, maintenance, and closing costs.

-

Stick to a comfortable monthly payment: Experts recommend that your monthly housing expenses should not exceed 28-30% of your gross income.

2. Define Your Must-Haves vs. Nice-to-Haves

Make a list of features you absolutely need in a home and those that would be nice but aren’t deal-breakers. Consider factors such as:

-

Location: Proximity to work, schools, amenities, and public transportation.

-

Size and layout: Number of bedrooms, bathrooms, and overall square footage.

-

Condition of the home: Are you willing to do renovations, or do you prefer move-in ready?

-

Future needs: If you plan to expand your family or work from home, ensure the home can accommodate your future lifestyle.

3. Work with a Real Estate Agent

A knowledgeable real estate agent can help you navigate the home-buying process, negotiate on your behalf, and find properties that fit your budget and needs. If you're a military family or a first-time buyer, working with an agent who understands your unique situation can be especially helpful.

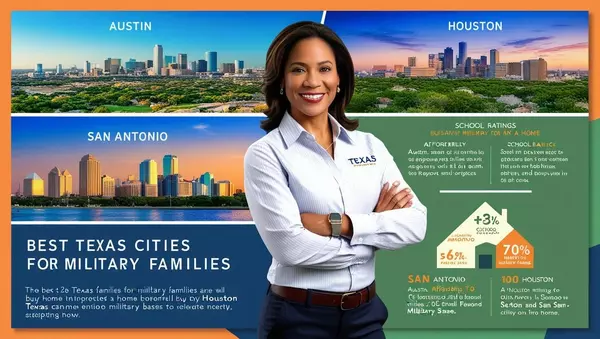

4. Research the Market

Understanding the local real estate market will help you make informed decisions. Some key things to research include:

-

Home prices in your desired area to determine if they align with your budget.

-

Market trends, such as whether it’s a buyer’s or seller’s market.

-

Neighborhood factors, including crime rates, school ratings, and future development plans.

5. Visit Multiple Homes and Compare

It’s essential to tour several homes before making a decision. When visiting homes:

-

Take notes and photos to remember details.

-

Check for any red flags, such as structural issues, mold, or outdated electrical and plumbing systems.

-

Consider the resale value based on location, condition, and market trends.

6. Make a Competitive Offer

Once you find the right home, your agent will help you craft a competitive offer based on market conditions and comparable home prices. Be prepared to negotiate and stay within your budget.

7. Get a Home Inspection and Finalize Financing

Before closing, schedule a professional home inspection to identify any potential issues. If everything checks out, finalize your financing and prepare for closing day.

Final Thoughts

Buying a home is one of the biggest financial decisions you’ll make, but with proper planning and guidance, you can find the perfect home that fits your budget. By setting realistic expectations, working with a trusted real estate agent, and staying informed, you’ll be well on your way to homeownership.

Are you ready to start house hunting? Contact me today for expert guidance tailored to your home-buying needs!

Categories

Recent Posts